My 5 year old son asked me about money last night before bed.

My 5 year old son asked me about money last night before bed.

His basic question was “How do we get more of it?”

Good question!

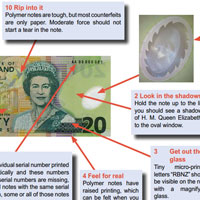

We spent a few minutes closely examining a 5 dollar note and I pointed out some of the security features like clear windows, watermarks and micro-printing that make it so hard to simply print out more for ourselves.

And then I told him the 3 basic ways to make money:

- Work for someone

- Sell something

- Invest in something

In a moment we’ll take a closer look at each one, and consider the marketing implications of each.

But first, are you more likely to ask the question “how do you earn money” or “how do you make money”?

The most common, is the latter. We use the phrase “make money” as if the stuff comes out of thin air.

Most monetary transactions these days are in fact in the thin air.

They are electronic transactions flying through the internet and phone lines. Rarely are they passed over from one human hand to another.

Anyway, the first way to make money is…

#1 Work For Someone

- Exchanging an hour of your time for an hours pay. You are selling your time

- If you live until your 80, that’s 700,800 hours you’ve got to sell

- But you might keep a third of those for yourself for sleeping, and another third for family time, resting and playing, leaving just 233,600 to sell

- This method does not scale. If you create enormous value for a business with a 60 minute phonecall with a new customer, you get paid the same as you did for that hour you spent on Facebook

How To Maximise Working For Someone

- Have you noticed that when you are job hunting, it feels like you are selling yourself to a potential employer? That’s exactly what you are doing

- Your potential future boss is estimating your capacity to create value for their business

- They know you’ll take holidays, you’ll get sick sometimes, you’ll lose focus or get distracted, but at the end of the day, they hope that you’ve created products or services that are of value to the customers of their business. They use that value to contribute to overheads, pay for the costs of doing business (including your wages/salary), and to compensate them for taking the risk on you

- When that value calculation is upsidedown, that’s when redundancies are made. Redundancy really means “for the foreseeable future we can’t sell the value that you create, so the business can’t afford to pay you to stay here”

- So if you are working for someone and you’re worried about redundancy, ask your boss what the most valuable outputs of your work are, and just focus on those

- Go beyond KPI’s and keep asking the question “why is that important? But why is that important?” Until you find out what is truely valuable

#2 Sell Something

- Eg Buy items in bulk and resell them to customers in smaller quantities (eg supermarkets do this all day)

- Eg Assemble an item that people want from components (eg a mobile phone is made of thousands of components)

- Eg Provide a service that people pay for (eg the delivery of packages to your home or office)

- Evening begging is a form of selling. You are selling the good feeling that comes from helping someone less fortunate

How To Maximise Selling Something

- In this scenario it’s about asking questions that uncover peoples wants and needs (often, they are problems that they want to solve)

- But better than that, it’s finding out what they are willing to pay to solve that problem

- But better than that, it’s asking them to pay in advance of you delivering that solution

#3 Invest In Something

- Eg Give your funds to a bank and earn interest

- Eg Buy or build a machine that makes widgets

- Eg Buy or build an asset that generates cashflow (eg a rental property)

- Eg Hire an employee that creates value for your customers

- Even playing the lottery or gambling is a form of investment. You are exchanging time and money for the chance to profit

How To Maximise Investing in Something

- The first 2 questions in this scenario are “What is the return on investment?” and “What is the risk of losing my entire investment?”

- The next question is “What are my investment alternatives and how do they compare?”

- Even with just 2 factors: return/reward and risk, evaluating your options can be enormously complicated

- The marketing questions are “what are you really selling?” and “who will pay for it?”

- For example, putting your money in a bank account is giving the bank permission to use your money for their own investments (such as issuing mortgages on property). In return you get a small fraction of their profits but with very little risk of losing your investment

In your lifetime you will dip in and out of all 3 categories all the time.

Your Thoughts?

What are your thoughts on this?

Have I missed a method of making money?

Have your say in the comments section below.

Interesting, certainly highlights that very different skills are required for success in each of the ways to make money… Cheers